美国通胀预期反应滞后,但是可能存在hyperinflation。

中国情况:

Idea:

- 国有资产+国有公司 behave like a huge government spending, huge public sector, or a combination between public and private sectors.

- modelling 国家政府置信度、公信度、(透明度)。E.G. 参考疫情经济对比

美国通胀预期反应滞后,但是可能存在hyperinflation。

中国情况:

Idea:

Edmund S. Phelps (new Keynesian) was awarded the 2006 Nobel Prize for the contribution of intertemporal tradeoffs in macroeconomic policy. The intertemporal tradeoffs are from mainly two parts. One is the tradeoff between unemployment and inflation. The other is about capital accumulation and economic growth.

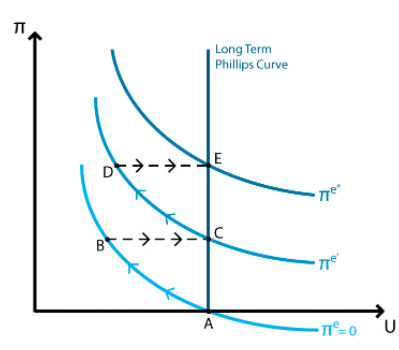

In the early 1960s, economists believed that the tradeoff between unemployment and inflation was stable, as the Phillps curve. In the late 1960s, Phelps challenged this view by considering expectation about future inflation.

One of Phelps’ major contributions to economics was the insight he provided on the interaction between inflation and unemployment. In the Expectations-Augmented Phillips curve, he combines current inflation with future inflation and unemployment.

Previous economists including Milton Friedman and Ludwig von Mises argued that people adapt their inflation expectations to account for the effects of expansionary monetary, Phelps is recognised as the first to formally model this phenomenon.

In the first period, the government decides to conduct an expansionary monetary policy, inflation would rise and unemployment would fall, based on the simply Phillps curve. However, a second or third time comes, agents would be quick to associate higher inflation with rising salaries in their expectation adjustment. That would anticipate that inflation would drain their purchasing power accordingly, and the monetary policy would have little effect.

A better way of helping low-skill workers is to expand the earned income tax credit, making it more available to more workers. This way would be more superior to the minimum wages.

The long term Phillips curve is vertical because of the potential GDP. The price level keeps increasing as the expansionary monetary policy. The unemployment rate decrease when the policy is released but the effects diminish in the long run.

Intuitively, if the Federal Reserve increased the money supply at a rate that caused a 5% inflation rate, then, with this higher inflation rate, wages offered would be higher than expected also. Unemployed workers looking for work would see wages that they would mistakenly think were higher in real terms and would, therefore, accept jobs at these wages sooner than otherwise. Millions of unemployed workers taking jobs just a few weeks earlier would result in a lower unemployment rate. Then, however, workers’ expectations would be adaptive; that is, they would adjust to reality. They would realize that the wages weren’t as high in real terms as they had thought, and some would quit and look for more lucrative work, thus slowly raising the unemployment rate. In other words, policymakers could temporarily reduce the unemployment rate by making inflation higher than people expected, but they could not achieve a long-run reduction in unemployment with an increase in inflation. In the long run, then, there is no tradeoff between inflation and unemployment. This striking finding is now mainstream economic wisdom.

Related to Robert Lucas’ work: Lucas emphasised “rational expectations” rather than “adaptive expectations”. The idea is that people would try to anticipate the future based on how the monetary authorities had acted in similar circumstances in the past. In this case, Lucas found even stronger results. Lucas’s model implied that the only way that policymakers could use monetary policy to affect the unemployment rate was by being unpredictable.

Phelps developed the golden rule of the intertemporal tradeoff between present and future consumption as it relates to capital investment and growth. Phelps’s model formally defines the rate of savings and investment that is necessary to create the maximum level of sustained consumption across successive generations.

In the early 1960s, he derived the “Golden Rule” of capital formation. The rule is that if one’s goal is to attain the maximum consumption per capita that is sustainable in the long run, annual saving as a percent of national income should equal capital’s income as a percent of national income.

In the late 1960s, Phelps did further work in this area with Robert Pollak. They argued that the government should force people to save more than they wish, on the grounds that people put too little weight on their children’s well-being. It seems that the political system, though, does the opposite, especially at the federal level. The federal government taxes the politically powerless younger generation to subsidize—through Medicare and Social Security—today’s politically powerful elderly.

Considering the current economy in China!

I denote \(c_1, l_1, L_1, y_1\) as the consumption, labour supply and demand, and outputs of relative high-quality goods. Also, denote \(c_2, l_2, L_2, y_2\) as those of relative low-quality goods. Note that the high-low quality stated in this working blog only refers to relative quality.

Consumers maximise their utility function subject to the budget constraint. For a representative consumer, the utility function is,

$$ \max_{c_1, c_2, l_1, l_2} u(c_1,c_2,1-l_1,1-l_2) $$

$$ s.t. \quad (l_1\cdot w_1)^i (l_2 \cdot w_2)^{1-i}\geq P_1 c_1 +P_2 c_2 $$

$$ i\in \{0,1\} $$

The wealth of consumers is in Bernoulli form because we assume each consumer can only provide a unique kind of labour in productions. \(i\) denotes the individual’s decision of providing labour for high-quality products or low-quality one.

Consumers provide labours \(l_1\) or \(l_2\), and consume goods \(c_1\) or \(c_2\).

Firms maximise profits. I simplify the model by considering only labour inputs as the factors input. The model could be further expanded by including capital term and letting the technology term be depending on other factor inputs. E.G. \(F( L, K )\).

$$ \max_{L_1, L_2} \pi = \max_{L_1, L_2} P_1 F(L_1)+P_2 F(L_2) – w_1 L_1 -w_2L_2 $$

Consumer:

$$ \frac{{\partial} \mathcal{L}}{\partial l_1}: u’_3=i\cdot \lambda (w_1 l_1)^{i-1} (w_2 l_2)^{1-i} \quad (1)$$

$$ \frac{{\partial} \mathcal{L}}{\partial l_2}: u’_4=(1-i)\cdot \lambda (w_1 l_1)^{i} (w_2 l_2)^{-i} \quad (2)$$

$$ \frac{\partial \mathcal{L}}{\partial c_1}: u’_1=\lambda P_1 \quad (3)$$

$$ \frac{\partial \mathcal{L}}{\partial c_2}: u’_2=\lambda P_2 \quad (4)$$

And I can get,

$$ \frac{u’_4}{u’_3}=\frac{1-i}{i}\frac{w_1 l_1}{w_2 l_2} \quad (5)$$

$$ \frac{P_1}{P_2}=\frac{u’_1(c_1)}{u’_2(c_2)} \quad (6)$$

Firms:

$$ \frac{\partial \pi}{\partial l_1}: P_1 F’_{l_1}=w_1 \quad(7)$$

$$ \frac{\partial \pi}{\partial l_1}: P_2 F’_{l_2}=w_2 \quad(8)$$

And get,

$$ \frac{w_1}{w_2}=\frac{P_1 F’_{l_1}}{P_2 F’_{l_2}} \quad(9)$$

Combine \((5)\), \((6)\) and \((9)\),

$$ \frac{u’_4}{u’_3}\frac{i}{1-i}\frac{l_2}{l_1}=\frac{u’_1}{u’_2}\cdot \frac{F’_1}{F’_2} $$

Apply the markets clearing condition,

$$\int l_1 =L_1$$

$$\int l_2 = L_2$$

$$ y_1=c_1 $$

$$ y_2=c_2 $$

The equilibrium condition could be rewritten as,

$$ \frac{u’_4}{u’_3}\cdot \frac{u’_2}{u’_1}=\frac{F’_1}{F’_2} $$

By aggregating individuals \(l_1\) and \(l_2\), \(i\) could then represent the proportion of people who provide labours for high-quality products or low-quality products. Thus, \(\frac{i}{1-i}=\frac{L_1}{L_2}\).

Assume \(y_1,y_2=F(l_1,l_2)=A[l_1^{\alpha}+l_2^{\alpha}]\). Production depends purely on labour inputs and

\left\{ \begin{aligned} F’_1=\alpha A l_1^{\alpha-1} \\ F’_2=\alpha A l_2^{\alpha-1} \end{aligned} \right. \quad \Rightarrow \quad \frac{F’_1}{F’_2}=(\frac{l_1}{l_2})^{\alpha-1}To be continued.

当前经济情况下(recession),准备金率调整对流动性释放的效果被削弱。参考liquidity trap & CiA model。且滞后性。

需求低,PPI高且增速快,CPI增高但增速显著低于PPI增速。于宏观总需求供给考量:

供给侧供给量基本稳定,但是供给侧价格上升(考虑AS曲线上移动)。其中供给侧价格提高来自于原材料价格升高,绿色金融要求对原料限制,以及大宗商品价格与美元绑定美元高通胀。

需求侧,需求量低,工资涨幅无法追赶物价涨幅,不消费。但是高通胀,金融市场规模预期扩大。同时低消费欲望拉低终端产品价格。

最终终端低价,原材料高价,导致生产者低利润。同时平台抽成导致生产者利润再次被压缩。病态经济结构。

解决:1. 从原材料价格入手:长期推断人民币国际化,短期限价补贴生产商(Problematic)。2. 从消费刺激入手:长期扩大内需(考虑Good-Bad Consumption转型),消费结构在转型,需要供给侧同时配合更新产品产品以与消费匹配,短期:新闻宣传(国民文化理念背景下,短期似乎无有效解决方案。可考虑政府购买,政策性囤货,或政府购买转移支付至欠发达地区)。3. 从降低中介平台费用入手(加强反垄断,2021年11月18日国家反垄断局已挂牌成立)。

思考:国家经济发展需要从生产及消费下手。而中间商虽然有加速资产配置消费配置的能力,但是过于泛滥及垄断的中间商(电商平台)同时带来了以下问题。1. 产品劣质。 2. 中间商利润过大,压榨生产者消费者surplus。此时即使市场达到类价格歧视形式,total surplus没有减少。但是由于consumer and producer surplus 减少带来了消费生产意愿降低!联系behavioral study和consumption preference。

22nd Nov 2021

People have less time to consume, thus consumption needs to be more effective, which links to the idea of the good-bad good.

People consume affordable goods. People from the less wealthy areas can only afford bad goods. However, with credits available, people prefer to consume high-quality goods. That logic constructs the relationship between credit availability and preference for high-quality goods.

The first oil crisis started with the oil embargo proclaimed by OPEC.

OPEC: Oil exporting nations accumulated vast wealth due to the price increase. US: the oil price increase induced the recession, inflation, reduced productivity, and low economic growth.

According to Keynesians, the growth in the money supply can increase employment and promote economic growth. Keynesian economists believe in the Philips relationship between unemployment (economic growth) and inflation. However, both of them hiked in the 1970s.

The prevailing belief has been that high levels of inflation were the result of an oil supply shock and the resulting increase in the price of gasoline, which drove the prices of everything else higher (cost-push inflation).

A now well-founded principle of economics is that excess liquidity in the money supply can lead to price inflation. Monetary policy was expansive during the 1970s, which could help explain the rampant inflation at the time.

“Inflation is always and everywhere a monetary phenomenon.”

Milton Friedman

During the energy crisis of the 1970s, while everyone was blaming OPEC in the early part of the 70s, or the Iranian revolution in 1979, Friedman recognized who the real culprits were — Richard Nixon, who in 1973 instituted wage-price controls and, following Nixon, Gerald Ford and Jimmy Carter who continued these price controls on oil, gasoline, and natural gas.

“The present oil crisis has not been produced by the oil companies. It is a result of government mismanagement exacerbated by the Mideast war.”

– Milton Friedman, “Why Some Prices Should Rise,” Newsweek, November 19, 1973.

Friedman believed prices could not increase without an increase in the money supply. The Fed followed a constrictive monetary policy that helped drive interest rates to double-digit levels, reduce inflation.

P.S. Fed’s credibility and inflation expectation (inflation targets) also play roles in resulting in stagflation.

Inflation (or hyperinflation) is a monetary phenomenon by Friedman and some economists. In China’s case, stagflation seems unable to happen if there are no vast increase in money supply and loss of credibility of the central bank.

保险研究:增加老年人对于secure money的使用,减少money held in the pocket,增加Velocity of Money,提高货币政策的效率。

Potential Ideas and Researches: 保险资金对对货币政策有效性的影响。建模+实证(see the example in the previous post: A Cash-in-Advance Model)。

In the utility function, consumption and leisure time might have interaction effects.

$$ U(C(L),L)$$

Currently, people’s overtime working hours increased. People hence spend more time on working and making money, and thus there is less time on leisure for people. Though wages are earned, people’s preference for less valuable goods is decreasing because of less time left on leisure. Meanwhile, consumption also takes time. Therefore, less leisure results in less consumption even though nominal income increase (did not consider the real terms now).

Ideas: Model(consumption is a function a leisure) + Empirical Analysis (include the interaction term)