Background: Efficient Market Hypothesis

The efficient market hypothesis generally states that the asset price has already reflected all the information (Fama, 1998).

This implies the stock price depends on all fundamentals and includes all information existing in the market. Any small deviations might be quickly diminishing with new information coming out. Therefore, the EMH rules out the profitable investment opportunity in the market, because the price is already the right price.

Is the market efficient or not?

The price might be incorrect in the real market. Actually, the anomaly, which is the deviation of the strategic price from the expected true price, seemingly does exist. Then an issue arises:

Whether the investor could beat the market?

To address this issue, we apply an asset pricing model such as CAPM to calculate the expected benchmark return we should get subject to some factors.

The anomaly can be expressed as:

\alpha=r_{real}-r_{benchmark}

This equation shows that alpha (anomaly), which is the alpha in CAPM, is the real-world return less the benchmark return.

Then, the efficiency can be examined by testing the existence of an anomaly. If an anomaly exists, it means the market is not quite efficient. Therefore, investment strategies could be applied to earn the abnormal return and beat the market. This test can be conducted by constructing a regression model as, \(r_{i,t} =\alpha+r_{f,t}+\beta \times (r_{m,t}-r_{f,t})\) and do joint hypothesis testing.

Here are some relative literature introducing that the market is inefficient. Schwert (2003) stated that the market is not efficient, indicated by the existence of anomaly; Jensen (1978) proofed the inefficiency after adjusting the inconsistent data and missed techniques; Latif et al. (2011) also demonstrated different types of anomalies generated from technical, fundamental and behavioural aspects.

Given that the market is inefficient, the question now is how investors could earn the abnormal profit.

How could investors earn the abnormal profit?

The strategy is to construct a financial portfolio earning the abnormal return (anomaly), and in that strategy, investors select stocks based on their certain characteristics. (two examples below).

The momentum strategy: stocks that performed well in the previous period would also outperform others in the following period (Jegadeesh & Titman, 1993). The contrarian effect is the opposite.

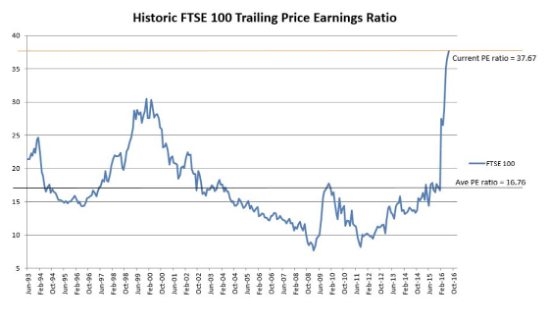

The value investing strategy: stocks with a high P/E ratio or P/B ratio are overvalued, vice versa. Stocks with such as low P/E ratio, Dividend Yield, P/B ratio, etc. are generally under-priced. Thus, buying those cheap stocks could result in a profitable opportunity.

There are numerous investment strategies as we discussed above, and investors could simply apply one strategy or even combine some of the strategies to construct a portfolio to beat the market.

How to test ‘beat the market’?

Applying back-testing to simulate the portfolio’s performance

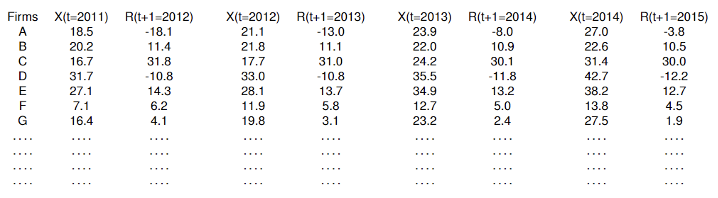

back-testing is the methodology by which people can see the performance of a certain strategy by some historical data (Campbell, 2005). Here is an example of back-testing below:

Firstly, investors could sort stocks by strategy. If they apply the momentum strategy, they simply sort stocks’ historical return \( (r_{t=1,i}) \) from high to low. Then, investors would make the quartile cut-off, selecting stocks in the first quartile (best-perform stocks) and keeping them into the next period. This periodical return would be the strategic return. After that, we sort the second period return \( (r_{t=2,i}) \), select a first quartile stock again, and keep them into the next period again and again.

Under this procedure, we could use the historical data to track strategy periodical performance. Then, we could examine the existence of an anomaly by subtracting strategic return from the benchmark return.

Reference

Campbell, S.D., 2005. A review of backtesting and backtesting procedures.

Fama, E.F., 1998. Market efficiency, long-term returns, and behavioral finance. Journal of financial economics, 49(3), pp.283-306.

Fama, E.F., 1998. Market efficiency, long-term returns, and behavioral finance. Journal of financial eco

Jegadeesh, N. and Titman, S., 1993. Returns to buying winners and selling losers: Implications for stock market efficiency. The Journal of finance, 48(1), pp.65-91.

Jensen, M.C., 1978. Some anomalous evidence regarding market efficiency. Journal of financial economics, 6(2/3), pp.95-101.

Latif, M., Arshad, S., Fatima, M. and Farooq, S., 2011. Market efficiency, market anomalies, causes, evidences, and some behavioral aspects of market anomalies. Research Journal of Finance and Accounting, 2(9), pp.1-13.

Lux, T. and Marchesi, M., 2000. Volatility clustering in financial markets: a microsimulation of interacting agents. International journal of theoretical and applied finance, 3(04), pp.675-702.

Schwert, G.W., 2003. Anomalies and market efficiency. Handbook of the Economics of Finance, 1, pp.939-974.