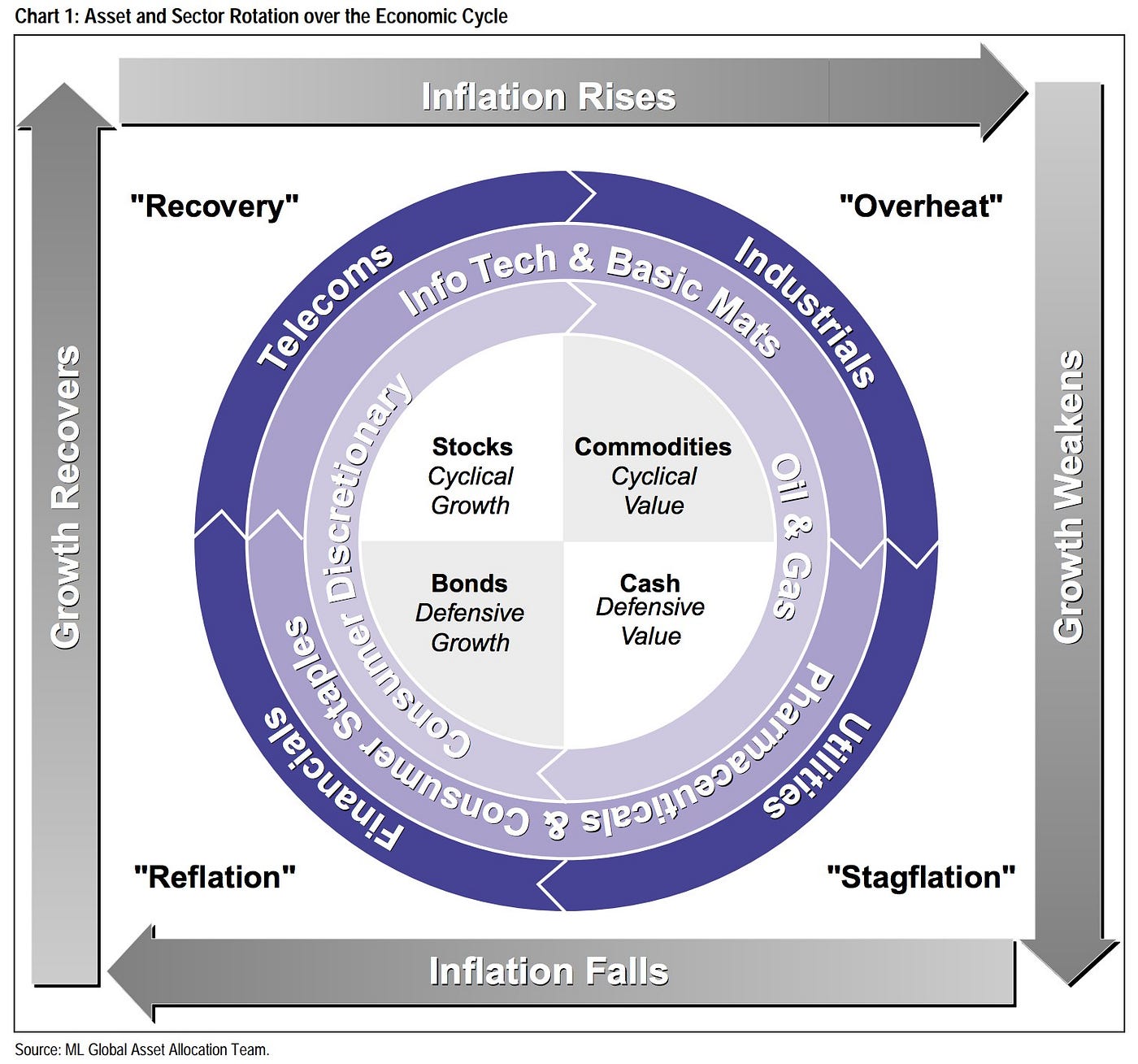

The Merrill Lynch Investment Clocks describe a framework for understanding the business cycle.

The Merrill Lynch clock separates the business cycle into four phases. Each phase is comprised of the direction of growth and inflation relative to their trends.

1. Reflation – 萧条

After stagflation, people are frustrated and have low confidence in investing.

Both the GDP growth and inflation are falling or lower than the trend. The stocks are suffering in a bear market but bonds suppose to be the most welcomed asset because of the generous monetary and fiscal support from governments and central banks (bail-out, cutting rates, and stimulus programs).

Jan 2020 till Apr 2020, the pandemic flowed globally. Governments of each country conducted policies of lockdowns. The economy was blocked, and the unemployment rate increased. A recession began globally.

- Low Growth and Low Inflation

- Bonds are attractive

2. Recovery – 复苏

Investors’ confidence has built up / recovered.

Growth starts to back on track while inflation still remains low. Stocks regain attraction with very attractive valuation and improving earnings. It is, of course, the most favorable asset at this stage.

From May 2020 to Feb 2021, the Central Banks and Fiscal Divisions of each country placed monetary policies and fiscal policies, aiming to boost the economy. A huge amount of money was pooled into the market. QE and Helicopter Drops were conducted and resulted in an increase of M2, about 10% in the European market, and 25.7% in the U.S. Meanwhile, the interest rate hit the floor. Banks with extra money reserves holding started to actively search for clients with the demand for money.

The good thing is money went to the market and smoothed the economy. The recession gets reversed a little bit. However, bad things happened at the same time that (1). individuals and firms held extra money. That fact raised people’s expectation of inflation, and thus invested their extra holding of money into stock markets, pushing an increase in the index; (2). Firms with not good financial and operating conditions were also granted credits and debts. Potential default probabilities increased.

- High Growth, and Low Inflation (but expected inflation increased)

- Stocks are attractive.

- P.S. Bitcoins are even more attractive, coz the limited supply and even more sensitive than stocks.

3. Overheat

Growth reaches its peak and slows down and inflation is rising. (does it sound familiar if you follow these days’ headlines?) Both stocks and bonds won’t perform well, but betting on commodities will be a proliferating and profitable strategy.

The economy got overheated, and the economy was still speedily moving until reaching a peak. After achieving the top, growth got slower.

The expected inflation in the recovery stage transferred to a true increase in inflation with high CPI. Investors started to be unconfident and started to pursue safety assets, which are necessities such as commodities (metals and crude oil).

- High Growth and High Inflation.

- Commodities are attractive.

4. Stagflation

Inflation is way out of control and that severely hurts consumer confidence. Central banks are forced to hike rates, and stocks, as one of the leading indicators of the economy, have already fallen. However, this stage of the cycle doesn’t happen that often in the last few decades, thanks to Fed’s “remarkable” economic interference policy, which is to print out enormous money to stimulate the economy meanwhile artificially setting interest rates low to control the inflation (however we just don’t know how long it could last). Flying to safety assets, cash is the best choice given the circumstance.

- The Fed’s policy works not bad because the U.S. dollar links with crude oil, and becomes one of the “safety assets”. However, other countries do not have that “lucky” chance.

- Low Growth and High Inflation.

- Even the U.S. Dollar is not safe enough, so people change to hold cash.

Reference

https://medium.com/@richardhwlin/how-does-investment-clock-work-c7d8fbbeb7bd