IMF Blog: Policymakers Need Steady Hand as Storm Clouds Gather Over Global Economy, by Pierre-Olivier Gourinchas, illustrated recent facts and economic data. Here is a brief presentation.

The world economic slowdown continues, Growth forecast in China is adjusted downward to 4.4% due to the weakening property sector and continued lockdowns by IMF.

Inflation

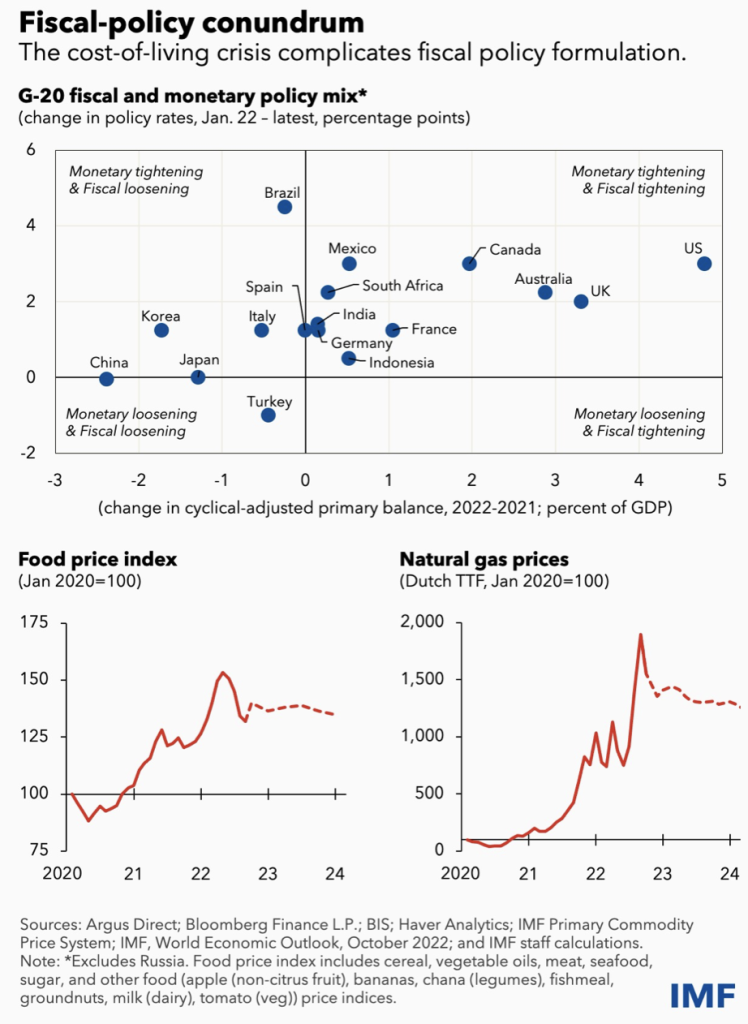

Rapidly rising prices, especially of food and the economy are causing serious hardship for households.

Inflation in China seems not that obvious, and the biggest problem, instead, is the slag of econ growth. Fortunately, wages are not increasing that much in most of the world economies. The hyperinflation raised from spikes in prices and wages is under control.

FOMC’s schedule of interest rate increases is expected to slow down, 50bp, in December.

The Chinese government is conducting loosening fiscal policy, stimulating the aggregate demand in part, and increasing the fiscal spending on infrastructure across countries through local financing platforms. The balance sheet is enlarging government leverage rate increases. The strong government is trying to raise confidence in individuals. However, monetary policy is limited due to the QT in the U.S. The exchange rate would be largely damaged if there were CB QE.

Energy Price

Food prices and energy prices surge to a high level and are expected to keep high as IMF expected.

OPEC decreases crude oil supply by 2 million barrer per day. IEA reported that US, as the target of global economic policy, released 15 million barrel of strategic crude oil reserve. US strategic crude oil reserve is about 401 million barrel.

OPEC和US对于石油价格博弈可能要追溯到2020年前,美国页岩油技术在2020年油价暴跌大背景下开始难以盈利。wait for further study.

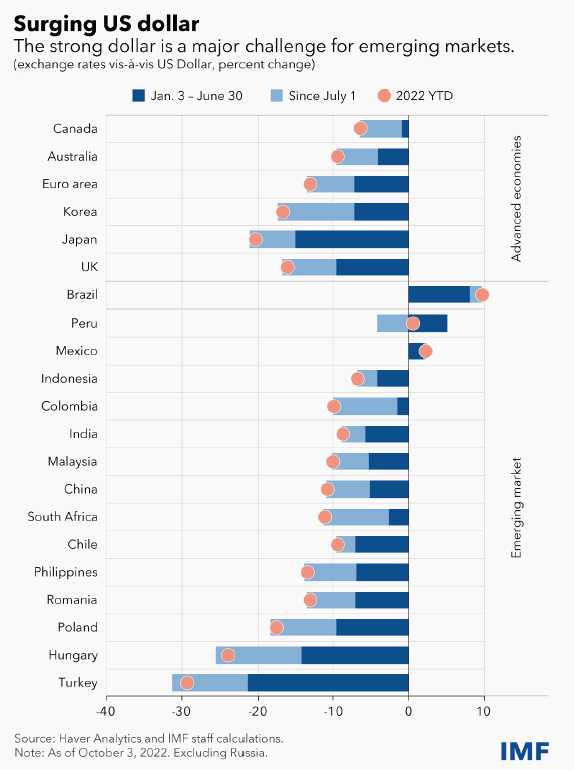

Strong USD

The strength of USD is a major challenge for many emerging market.

The appropriate response in most emerging and developing countries is to calibrate monetary policy to maintain price stability, while letting exchange rates adjust, conserving valuable foreign exchange reserves for when financial conditions really worsen.

In the tradeoff between the economic growth and the inflation, inflation seems become a piori target. The economy still has a bottom support, rigid demands such as foods, energy, accommodations etc. However, inflation is linked with the nomial term and could be even worsen off.