by Robert T. Kiyosaki

Introduction

The author has two “Dad”, one is his real dad, and the other is his friend’s dad. Both his dad and his friend dad are friends as well. For his two dads, one is rich and the other is poor, financially.

One work for bureau and as a professor at university. The other works for his own and strike before attending to college.

One dad had a habit of putting his brain to sleep when it came to finances, and the other had a habit of exercising his brain. For example, one says “I can’t afford it”, the brain stops working. The other ask a question “How can I afford it”, you brain is put to work.

One wanted the author to study hard, earn a degree, and get a good job to earn money, want the author to study to become a professional, an attorney or an accountant, and to go to business school for MBA. The other encouraged the author to study to be rich, to understand how money works, and make money works for you per se.

The rich dad is the one without even a college degree.

The book is not to compare the ideas from the rich and poor dad, but discuss how the rich dad’s insight affects the author.

Chapter 1: The Rich Don’t Work for Money

- Life is difficult. Life pushes all of us around. Some people give up. A few learn the lesson and move on. They welcome life pushing them around. To these few people, it means they need and want to learn something. Learn and move one from the life, instead of blaming. Do not blame, you only are blaming or pushing back against the boss, the job, the wife. However, it is the life that pushing.

Stop blaming the life, instead change yourself, learn something, and grow wiser.

-

The poor and the middle class work for money. The rich have money work for them.

-

Avoid one of life’s biggest trap. Some can see things most people never have the benefit of seeing because their vision is too narrow. Most people never see the trap they are in.

-

The Rat Race: The pattern of get up, go to work, pay bills; get up, go to work, pay bills. People’s lives are forever controlled by two emotion: fear and greed. Offer them more money and they continue the cycle by increasing their spending.

However, do not get in trapped by the Rat Race, do not get trapped by those two emotions: fear and greed.

Tell yourself the truth what you feel not the emotion.

Do not be afraid of losing money.

Avoid the trap caused by those two emotions, fear and desire. Use them in your favour, not against you.

Chapter 2: Why Teach Financial Literacy?

-

Rule #1: You must know the difference between an asset and a liability, and buy assets.

Rich people acquire assets. The poor and middle class acquire liabilities that they think are assets.

Asset put money in your pocket. Nice, simple, and usable.

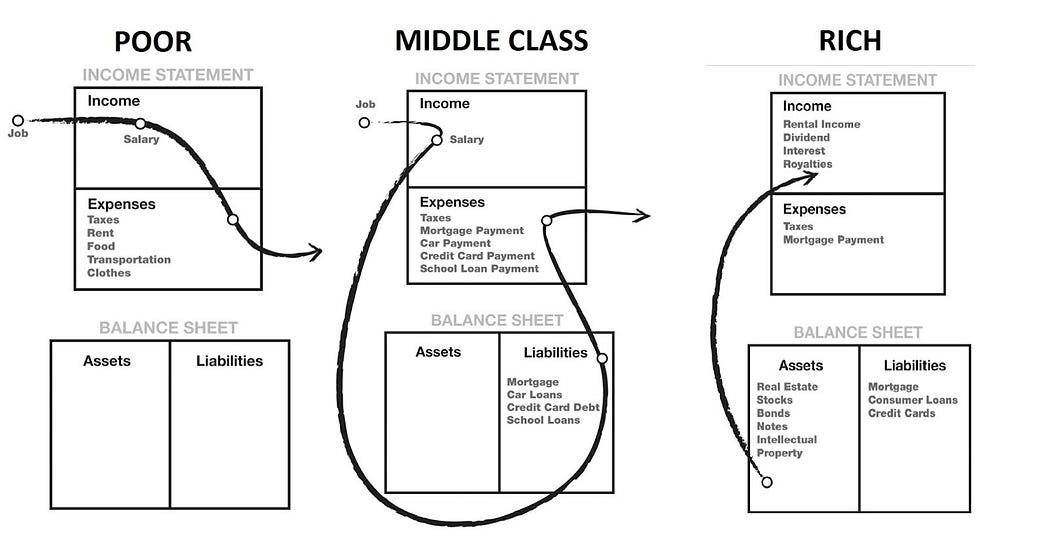

If you want to be rich, simply spend your life buying or building assets. For figures below, I/S of the Rich, Middle class, and Poor are shown.

For the Rich Dad, real estate is on the liability side. Money flow to expense, and run away.

For the Poor Dad, real estate in on the asset side. Money flow as income, get into the I/S.

-

Why the Rich Get Richer?

The asset column generates more than enough income to cover expenses, with the balance reinvested into the asset column. The asset column continues to grow and, therefore, the income it produces grows with it.

-

Why the Middle Class Struggle?

Their primary income is through their salary. As their wages increase, so do their taxes. Their expenses tend to increase in proportion to their salary increase: hence, the phrase “the Rat Race”. They treat their home as their primary asset, instead of investing in income-producing assets.

-

Work for Your Own.

- You work for the Company:

Employees make their business owner or the shareholder rich, not themselves. Your efforts and success will help provide for the owner’s success and retirement.

- You work for the Government:

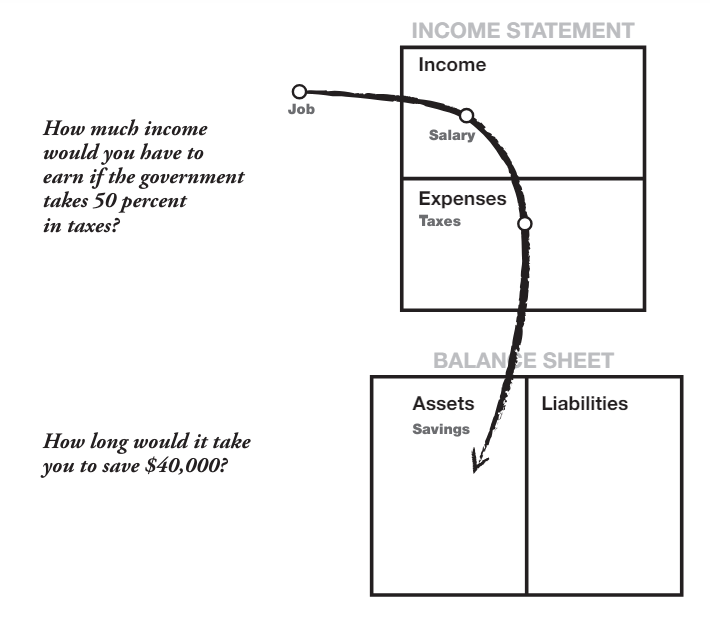

The government takes its share from your paycheck before you even see it. By working harder, you simply increase the amount of taxes taken by the government. Most people work from January to May just for the government.

- Your work for the Bank:

After taxes, your next largest expense is usually your mortgage and credit-card debt.

Build an asset column that makes you financially independent. If you quit the job today, it still covers your monthly expenses with the cash flow from the asset.

-

Invest the excess cash flow from your assets reinvested into the asset column. The more money that goes into the asset column, the more asset column grows.

-

In short:

- The rich buy assets

- The poor only have expenses.

- The middle class buy liabilities they think are assets.

Chapter 3: Mind You Own Business

Ray Kroc, the founder of McDonald’s, is not doing hamburger business. The real business behind it is the real estate.

- Mind your own business. Your business resolves around your asset column, not your income column.

-

Keep expenses low, reduce liabilities, and diligently build a base of solid assets.

-

Categories of real assets the author mentioned: (in the view of the author)

- Business that do not require my presence I own them, but they are managed or run by other people. If I have work there, it’s not a business. It becomes my job.

- Stocks

- Bonds

- Income-generating real estate

- Notes (IOUs)

- Royalties from intellectual property such as music, scripts, and patents.

- Anything else that has value, produces income or appreciates, and has a ready market.

When the author is a boy, The educated dad (poor dad) encouraged the author to find a safe job. But, the rich dad encouraged him to begin acquiring assets that he love.

Start a company, not run it. Stocks are the similar rationale.

Minding your business doesn’t mean starting a company, though for some people it will. Instead, your business revolves around your asset column, not your income

-

Luxuries.

An important distinction is that rich people buy luxuries last, while the poor and middle class tend to buy luxuries first. The poor and the middle class often buy luxury item like big houses, diamonds, furs, jewelry, or boats because they want to look rich. They look rich, but in reality they just get deeper in debt on credit.

Buying a luxury on credit often causes a person to eventually resent that luxury because the debt becomes a financial burden.

Chapter 4: The History of Taxes and The Power of Corporations

Though the popular sentiment is that the rich should pay more in taxes and give to the poor, in reality it is the middle class that is heavily taxed, especially the educated upper-income middle class.

What historical dates fail to reveal is that both of taxes were initially levied against only the rich. That idea of taxes was made popular, and accepted by the majority, by telling the poor and the middle class that taxes were created only to punish the rich. This is how the masses voted for the law, and it became constitutionally legal.

Although it was intended to punish the rich, in reality it wound up punishing the very people who voted for it, the poor and middle class.

The poor dad is a government bureaucrat, the rich dad is a capitalist. They get paid, and the success is measured on opposite behaviour. The poor dad get paid to spend money and hire people. The more he spends and the more people he hires, the larger his organisation becomes. In the government, a large organisation is a respected organisation. And, as the government grows, more and more tax dollars are needed to support it.

On the other hand, with in the rich dad organisation, the fewer people he hire, and less money he spend, the more he is respected by the investors.

The rich dad said that government workers were a pack of lazy thieves. The poor dad said the rich were greedy crooks who should be made to pay more taxes.

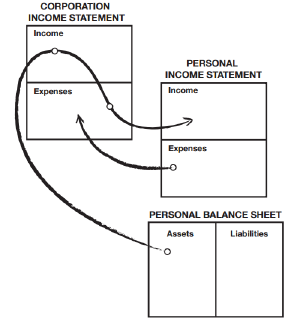

- Form a Company. A corporation is merely a legal document that creates a legal body without a soul. Using it, the wealth of the rich was once again protected. It was popular because the income-tax rate of a corporation is less than the individual income-tax rates. In addition, certain expenses could be paid by a corporation with pre-tax dollars.

In addition, even been a leader is still working for others. Why not own a company to let others work for you.

-

Financial IQ: get certain areas of expertise:

- Accounting

- Investing

- Understanding markets

- The laws:

- Tax advantages: a corporation can do many things that an employee cannot, like pay expenses before paying taxes. A corporate earns, spends everything it can, and is taxed on anything that is left. It’s one of the biggest legal tax loopholes that the rich use. For example, by owning your own corporation, your vacations can be board meetings in Hawaii. Car payments, insurance, repairs, and health-club memberships are company expenses. Most restaurant meals are partial expenses. It’s done legally with pre-tax dollars.

- Protection from lawsuits

In summary:

- Business Owners with Corporations:

- Earn +

- Spend –

- Pay Taxes %

- Employees Who Work for Corporations

- Earn +

- Pay Taxes %

- Spend –

Chapter 5: The Rich Invest Money

Once we leave school, most of us know that it is not so much a matter of college degrees or good grades that count. In the real world outside of academics, something more than just grades is required. That label decides one’s future much more than school grades do.

- Financial Intelligence is made up of four main technical skills, again.

- Accounting

- Investing

- Understanding markets

- The law

- The overall philosophy is to plant seeds inside my asset column. The author start small and plant seeds. Some grow; some don’t. The author use two main vehicles to achieve financial growth: real estate (including REIT) and small-cap stocks.

- The real estate is stable and slow-moving. The cash flow is fairly steady and has a good chance, if properly managed, of increasing in value. The beauty of a solid base of real estate is that it allows to take greater risks of then investing in stocks.

- Some people says, you cannot buy real estate cheap. That is not the author’s experience. Even in New York or Tokyo, or just outskirts of the city, prime bargains are overlooked by most people, or within a short driving distance.

- However, gain is together with risks. It is not gambling if you know what you’re doing. It is gambling if you’re just throwing money into a deal an praying.

-

Most people never win because they’re more afraid of losing. That is why I found school so silly. In school we learn that mistakes are bad, and we are punished for making them. Yet if you look at the way humans are designed to learn, we learn by making mistakes. We learn to walk by falling down. If we never fell down, we would never walk. The same is true for learning to ride a bike. I still have scars on my knees, but today I can ride a bike without thinking. The same is true for getting rich. Unfortunately, the main reason most people are not rich is because they are terrified of losing. Winners are not afraid of losing. But losers are. Failure is part of the process of success. People who avoid failure also avoid success.

-

There are two types of investors:

- The first and most common type is a person who buys a packaged investment. They call a retail outlet, such as a real estate company, a stockbroker, or a financial planner, and they buy something. It could be a mutual fund, a REIT, a stock or a bond. It is a clean and simple way of investing. An analogy would be a shopper who goes to a computer store and buys a computer right off the shelf.

- The second type is an investor who creates investments. This investor usually assembles a deal in the same way a person who buys components builds a computer. I do not know the first thing about putting components of a computer together, but I do know how to put pieces of opportunities together, or know people who know how.

Try to be the second type. And, if you want to be the second type of investor, you need to develop three main skills.

- Find an opportunity that everyone else missed. You see with your mind what others miss with their eyes. For example, a friend bought this rundown old house. It was spooky to look at. Everyone wondered why he bought it. What he saw that we did not was that the house came with four extra empty lots. He discovered that after going to the title company. After buying the house, he tore the house down and sold the five lots to a builder for three times what he paid for the entire package. He made $75,000 for two months of work. It’s not a lot of money, but it sure beats minimum wage. And it’s not technically difficult.

-

Organize smart people. Intelligent people are those who work with or hire a person who is more intelligent than they are. When you need advice, make sure you choose your advisor wisely

If you do not want to learn those skills, then being a type-one investor is highly recommended.

There is always risk, so learn to manage risk instead of avoiding it

Chapter 6: Work to Learn – Don’t Work for Money

- Financial intelligence is a synergy of accounting, investing, marketing, and law. Combine those four technical skills and making money with money is easier than most people would believe. However, when it comes to money, the only skill most people know is to work hard.

Instead of simply working for money and security, take a second job to learn a second skill.

-

Start to do it. Life is much like going to the gym. The most painful part is deciding to go. Once you get past that, it’s easy. There have been many days I have dreaded going to the gym, but once I am there and in motion, it is a pleasure. After the workout is over, I am always glad I talked myself into going.

-

Get to learn the skill of sales and marketing. The world is filled with talented poor people. They focus on perfecting their skills at building a better hamburger rather than the skills of selling and delivering the hamburger. Maybe McDonald’s does not make the best hamburger, but they are the best at selling and delivering a basic average burger.

The ability to sell – to communicate to another human being, be it a customer, employee, boss, spouse, or child – is the base skill of personal success.

The skills of selling and marketing are difficult for most people, primarily due to their fear of rejection. The better you are at communicating, negotiating, and handling the fear of rejection, the easier life is.

-

Do not trapped by one skill. The author’s educated dad became more trapped the more specialised he got. Although his salary went up, his choices diminished. Sooner after he was locked out of government work, he found out how vulnerable he really was professionally. It is like professional athletes who suddenly are injured or are too old to play. Their once high-paying position is gone, and they have limited skills to fall back on. The negative example is that, when it comes to money, the only skill people knows is working hard.

-

Rich dad encourage one to know a little about a lot, to work with people smarter, and to bring smart people together to work as a team. This is called a synergy of professional specialties.

-

Job security meant everything to the author’s educated dad. Learning meant everything to the rich dad.

If you are unwilling to work to learn something new and instead insist on becoming highly specialized within your field, make sure the company you work for is unionized.

-

The main management skills needed for success are (1) management of cash flow, (2) management of systems, and (3) management of people. The most important specialised skills are sales and marketing. Communication skills such as writing, speaking, and negotiating are crucial to a like of success. Attend courses or buy educational resources to expand the knowledge.

Chapter 7: Overcoming Obstacles

-

Overcome fear

Failure inspires winners. Failure defeats losers. This is the biggest secret of winners.

If you have little money and you want to be rich, you must first be focused, not balanced. To gamble, not to diversify, if you have little money.

Do not do what poor and middle-class people do: put their few eggs in many baskets. Put a lot of your eggs in a few baskets and FOCUS: Follow One Course Until Successful.

Think like a Texan. Win big, lose big – it’s the attitude toward that loss that matters.

-

Overcome Cynicism

Doubts and cynicism keep most people poor. Rich dad liked to say “Cynics criticise, and winners analyse.” Winners keep their eyes open and see opportunities everyone else missed.

When someone says, “I don’t want to fix toilets”, I want to fire back, “What makes you think I want to?”. Nobody want to fixed toilet, but what if you have to do? The real estate is the investment vehicle. however if you focus on the toilets, instead of the investment, it makes you poor.

That is what rich dad meant by “I-don’t-wants hold the key to your success.” Because I do not want to fix toilets either, I figured out how to buy more real estate and expedite my getting out of the Rat Race. The people who continue to say “I don’t want to fix toilets” often deny themselves the use of this powerful investment vehicle. Toilets are more important than their freedom.

So, how the author manage his real estate, he shop hard for a property manager who does fix toilets. And by finding a great property manager who runs houses or apartments, well, the cash flow goes up.

-

In the stock market, I often hear people say, “I don’t want to lose money.” Well, what makes them think I or anyone else likes losing money? They don’t make money because they choose to not lose money. They are keeping themselves from making money by closing their minds to that investment vehicle.

-

Overcome Laziness.

One of the most common forms of laziness is staying busy. Too busy to take care of your wealth, or health, or relationship. To be a little greed to cure the problem.

Change your mindset from “I can’t afford it” to “How can I afford it?”

Today, I often meet people who are too busy to take care of their wealth. And there are people too busy to take care of their health. The cause is the same. They’re busy, and they stay busy as a way of avoiding something they do not want to face. Nobody has to tell them. Deep down they know. In fact, if you remind them, they often respond with anger or irritation.

Yet deep down they know they are avoiding something important. That’s the most common form of laziness: laziness by staying busy. So what is the cure for laziness? The answer is—a little greed.

When the spirit is screaming, “Come on. Let’s go to the gym and work out.” And the lazy mind says, “But I’m tired. I worked really hard today.” Or the human spirit says, “I’m sick and tired of being poor. Let’s get out there and get rich.” To which the lazy mind says, “Rich people are greedy. Besides it’s too much bother. It’s not safe. I might lose money. I’m working hard enough as it is. I’ve got too much to do at work anyway. Look at what I have to do tonight. My boss wants it finished by morning.”

So how do you beat laziness? Once again, the answer is a little greed.

-

Overcoming Bad Habits

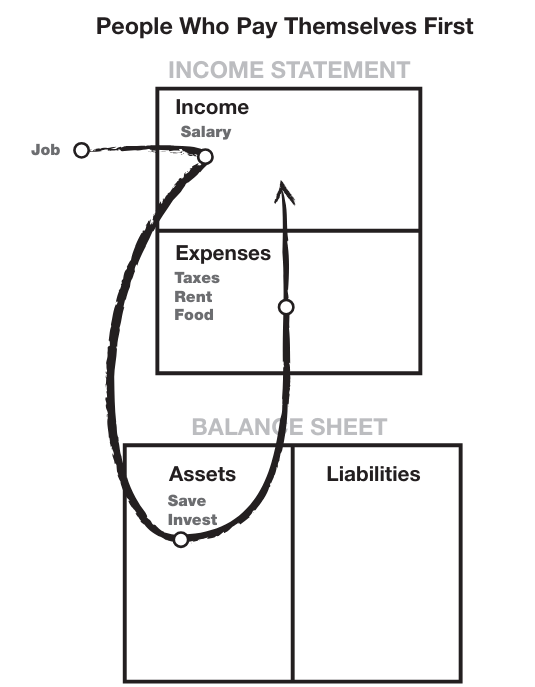

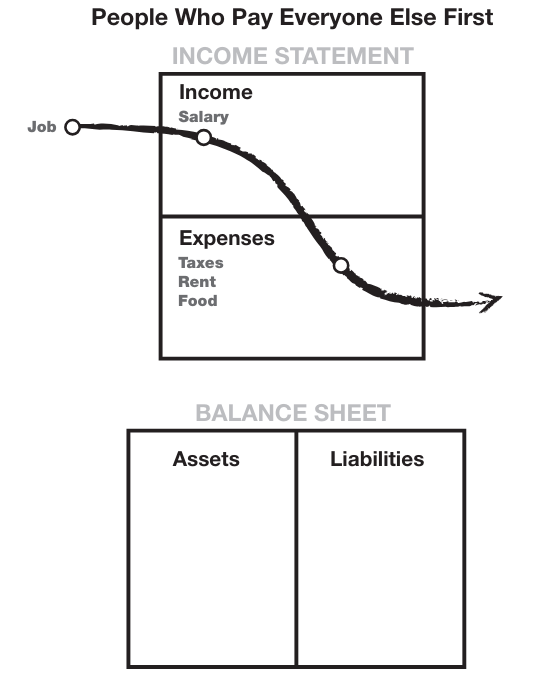

To be successful, you must develop successful habits. Poor dad always paid everyone else first and himself last, but he rarely had left over. Rich dad always paid himself first, even if he was short of money.

He knew that creditors and the government would make a big enough flap if he didn’t pay them that it would motivate him to seek other forms of income to pay them. If he paid himself last, he wouldn’t feel that kind of productive pressure. Forcing himself to think about how to come up with the extra income to pay the creditors made him fiscally stronger.

“So you see, after paying myself, the pressure to pay my taxes and the other creditors is so great that it forces me to seek other forms of income. The pressure to pay becomes my motivation. I’ve worked extra jobs, started other companies, traded in the stock market, anything just to make sure those guys don’t start yelling at me. That pressure made me work harder, forced me to think, and all in all, made me smarter and more active when it comes to money. If I had paid myself last, I would have felt no pressure, but I’d be broke.”

-

Overcoming Arrogance

Rich dad said every time he had been arrogant, he had lost money because he thought that what he didn’t know wasn’t important.

Many people use arrogance to hide their own ignorance. Do not be ignorance, find an expert in the field to educate yourself.

What I know makes me money. What I don’t know loses me money.

Chapter 8: Getting Started

You must awaken the financial genius sleeping within in order to find these great deals. The culture has told us that the love of money is the root of all evil, that we just need to find a profession and work hard and the government will take care of us when we’re old. The message is still to work hard, earn money, and spend it, and when we run short, we can always borrow more — and that is why, for so many of us, our financial genius within is asleep.

But we must awaken that financial genius in order to find million-dollar deals of a lifetime. It is far easier to simply find a job and work for money, but that is not the path to wealth.

There are 10 steps as a process to develop your god-given powers, powers over which only you have control.

- Find a reason greater than reality: the power of spirit

The author interviews a athlete who has super-human ambition and sacrifice. The athlete said “I do it for myself and the people I love. It’s love that gets me over the hurdles and sacrifices.”

Without a strong reason or purpose, anything in life is hard.

-

Make daily choices: the power of choice

Invest first in education. In reality, the only real asset you have is your mind, the most powerful tool we have dominion over. Each of us has the choice of what we put in our brain once we’re old enough. You can watch TV, read golf magazines, or go to ceramics class or a class on financial planning. You Choose. Most people simply buy investments rather than first investing in learning about investing.

The author loves CDs and audio books. The reason is he can easily review what he just heard. Instead of becoming arrogant and critical, he simply listened to that five-minute stretch at least 20 times, maybe more. By keeping the mind open, he understood why he said what he said.

Arrogant or critical people are often people with low self-esteem who are afraid of taking risks. That’s because, if you learn something new, you are then required to make mistakes in order to fully understand what you have learned.

There are so many “intelligent” people who argue or defend when a new idea clashes with the way they think. In this case, their so-called intelligence combined with arrogance equals ignorance. Each of us knows people who are highly educated, or believe they are smart, but their balance sheet paints a different picture. A truly intelligent person welcomes new ideas, for new ideas can add to the synergy of other accumulated ideas. Listening is more important than talking. If that were not true, God would not have given us two ears and only one mouth. Too many people think with their mouth instead of listening in order to absorb new ideas and possibilities. They argue instead of asking questions.

The author take a long view on my wealth. He do not subscribe to the get-rich-quick mentality most lottery players or casino gamblers have. He may go in and out of stocks, but he is long on education. If you want to fly an airplane, he advises taking lessons first. He is always shocked at people who buy stocks or real estate, but never invest in their greatest asset, their mind. Just because you bought a house or two does not make you an expert at real estate.

-

Choose friends carefully: the power of association

The author will admit that there are people he have actually sought out because they had money. But he was not after their money; he was seeking their knowledge.

Don’t listen ti poor or frightened people.

Keep your mind open, because both have valid points. Unfortunately, most poor people listen to Chicken Little.

One of the hardest things about wealth-building is to be true to yourself and to be willing to not go along with the crowd. This is because, in the market, it is usually the crowd that shows up late that is slaughtered. If a great deal is on the front page, it’s too late in most instances. Look for a new deal. As we used to say as surfers: “There is always another wave.” People who hurry and catch a wave late usually are the ones who wipe out.

Smart investors don’t time the markets. If they miss a wave, they search for the next one and get themselves in position. This is hard for most investors because buying what is not popular is frightening. Timid investors are like sheep going along with the crowd. Or their greed gets them in when wise investors have already taken their profits and moved on. Wise investors buy an investment when it’s not popular. They know their profits are made when they buy, not when they sell. They wait patiently. As I said, they do not time the market. Just like a surfer, they get in position for the next big swell.

Regarding the “Insider Trading”. How far away from the inside are you? The reason you want to have rich friends is because that is where the money is made. It’s made on information. You want to hear about the next boom, get in, and get out before the next bust. I’m not saying do it illegally, but the sooner you know, the better your chances are for profits with minimal risk. That is what friends are for. And that is financial intelligence.

-

Master a formula and then learn a new one: the power of learning quickly

Learn a formula.

Learned a lot that made you stock and real estate investing more meaningful and lucrative.

In today’s fast-changing world, it’s not so much what you know anymore that counts, because often what you know is old. It is how fast you learn. That skill is priceless. It’s priceless in finding faster formulas—recipes, if you will—for making dough. Working hard for money is an old formula born in the day of cavemen.

-

Pay yourself first: the power of self-discipline

If you cannot get control of yourself, do not try to get rich.

It is the lack of self-discipline that causes most lottery winners to go broke soon after winning millions.

Simply put, people who have low self-esteem and low tolerance for financial pressure can never be rich. As I have said, a lesson learned from my rich dad was that the world will push you around. The world pushes people around, not because other people are bullies, but because the individual lacks internal control and discipline. People who lack internal fortitude often become victims of those who have self-discipline.

The three most important management skills necessary to start your own business are management of:

- Cash Flow

- People

- Personal Time

The skills to manage these three could apply to anything.

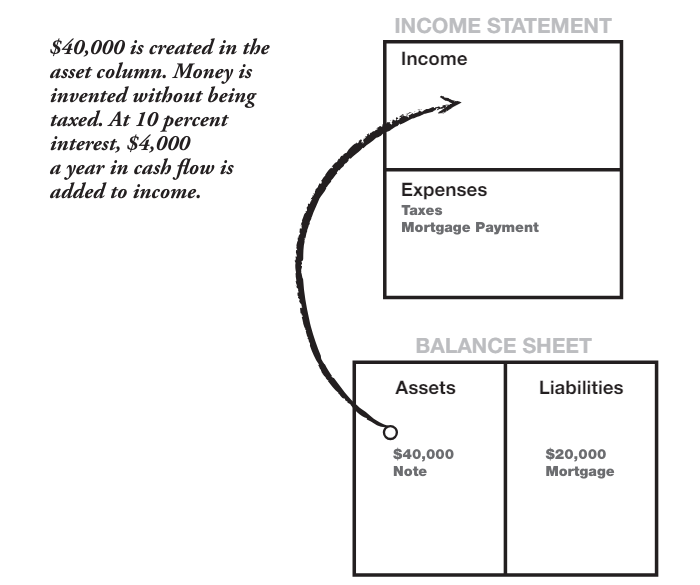

Cash flows go to asset, can generate further cash flows. The above figure is when you pay yourself fits. However, the figure below is if salary goes to pay expenses.

To successfully pay yourself first, keep the following in mind:

- Don’t get into large debt positions that you have to pay for. Keep your expenses low. Build up assets first. Then buy the big house or nice car. Being stuck in the Rat Race is not intelligent.

- When you come up short, let the pressure build and don’t dip into your savings or investments. Use the pressure to inspire your financial genius to come up with new ways of making more money, and then pay your bills. You will have increased your ability to make more money as well as your financial intelligence.

- Pay your brokers well: the power of good advice

Today, the author has expensive attorneys, accountants, real estate brokers, and stockbrokers. Why? Because if, and the author do mean if, the people are professionals, their services should make you money. And the more money they make, the more money the author make.

We live in the Information Age. Information is priceless. A good broker should provide you with information, as well as take the time to educate you.

A good broker saves me time, in addition to making me money. A broker is my eyes and ears in the market.

When the author interview any paid professional, he first find out how much property or stocks they personally own and what percentage they pay in taxes. And that applies to the author’s tax attorney as well as t the accountant. The author have an accountant who minds his own business. His profession is accounting, but his business is real estate.

Find a broker who has your best interests at heart. Many brokers will spend the time educating you, and they could be the best asset you find. Just be fair, and most of them will be fair to you. If all you can think about is cutting their commissions, then why should they want to help you? It’s just simple logic.

-

Be an Indian giver: the power of getting something for nothing

When the first European settlers came to America, they were taken aback by a cultural practice some American Indians had. For example, if a settler was cold, the Indian would give the person a blanket. Mistaking it for a gift, the settler was often offended when the Indian asked for it back.

The Indians also got upset when they realized the settlers did not want to give it back. That is where the term “Indian giver” came from, a simple cultural misunderstanding.

The author pulls the initial dollar amount out, and stop worrying about the fluctuations of the market, because the initial money is back and ready to work on another asset.

The author also lose. On an average 10 investments, he hit home runs on two or three, while five or six do nothing, and he lose on two or three

Wise investors must look at more than ROI. They look at the assets they get for free once they get their money back. That is financial intelligence.

-

Use assets to buy luxuries: the power of focus

if a person cannot master the power of self discipline, it is best not to try to get rich. This is because, although the process of developing cash flow from an asset column is easy in theory, what’s hard is the mental fortitude to direct money to the correct use. Due to external temptations, it is much easier in today’s consumer world to simply blow money out the expense column. With weak mental fortitude, that money flows into the paths of least resistance. That is the cause of poverty and financial struggle.

Developing cash flow from an asset column is easy in theory — what’s hard is the mental fortitude to direct money to the correct use. Borrowing money is easy in the short term but harder in the long run.

-

Choose heroes: the power of myth

By having heroes, we tap into a tremendous source of raw genius. Learn from someone.

-

Teach and you shall receive: the power of giving

“Teach and you shall receive”. The more the author teaches those who want to learn, the more he learn. If you want to learn about money, teach it to someone else. A torrent of new ideas and finer distinctions will come in

Chapter 9: Still Want More? Here Are Some To Do’s

The to-do list might be as the following:

- Stop doing what you’re doing.

Take a break and assess what is working and what is not working.

-

Look for new ideas.

Go to bookstores and search for books on different and unique subjects. The book The 16 Percent Solution by Joel Moskowitz taught Robert something new and spurred him to action.

-

Find someone who has done what you want to do.

Take them to lunch and ask them for tips and tricks of the trade.

-

Take classes, read, and attend seminars.

Robert searches newspapers and the Internet for new and interesting classes.

And,

- Make an offer, someone may say yes.

You don’t know what the right price is until you have a second party who wants to deal. Most sellers ask too much. It is rare that a seller asks a price that is less than something is worth. It’s fun and only a game. Make offers. Someone might say yes. (And make offers with escape clauses)

A friend wanted me to show her how to buy apartment houses. So one Saturday she, her agent, and I went and looked at six apartment houses. Four were dogs, but two were good. I said to write offers on all six, offering half of what the owners asked for. She and the agent nearly had heart attacks. They thought it was rude, and would offend the sellers, but I really don’t think the agent wanted to work that hard. So they did nothing and went on looking for a better deal.

No offers were ever made, and that person is still looking for the right deal at the right price. Well, you don’t know what the right price is until you have a second party who wants to deal.

Make an offer, someone may say yes.

lol

I always make offers with escape clauses. In real estate, I make an offer with language that details “subject-to” contingencies, such as the approval of a business partner. Never specify who the business partner is. Most people don’t know that my partner is my cat. If they accept the offer, and I don’t want the deal, I call home and speak to my cat. I make this ridiculous statement to illustrate how absurdly easy and simple the game is. So many people make things too difficult and take it too seriously.

And more hints:

- Finding a good deal, the right business, the right people, the right investors, or whatever is just like dating. You must go to the market and talk to a lot of people, make a lot of offers, counteroffers, negotiate, reject, and accept.

-

Jog, walk, or drive a certain area once a month for 10 minutes.

Robert has found some of his best real estate investments doing this. He will jog a certain neighborhood for a year and look for change. For there to be profit in a deal, there must be two elements: a bargain and change. There are lots of bargains, but it’s change that turns a bargain into a profitable opportunity.

-

Shop for bargains in all markets.

Consumers will always be poor. When the supermarket has a sale, say on toilet paper, the consumer runs in and stocks up. But when the housing or stock market has a sale, most often called a crash or correction, the same consumer often runs away from it.

Remember: Profits are made in the buying, not in the selling.

-

Look in the right places.

-

Look for people who want to buy first. Then look for someone who wants to sell.

Buy a pie, and cut it in pieces. Most people look for what they can afford, so they look too small. They buy only a piece of the pie, so they end up paying more for less. Small people remain small because they think small, act alone, or don’t act all.

-

Learn from history.

All the big companies on the stock exchange started out as small companies.

-

Action always beats inaction.

Take action before you can receive the financial rewards. Act Now.