The Paris Club (Club de Paris, 巴黎俱乐部) has reached 478 agreements with 102 different debtor countries. Since 1956, the debt treated in the framework of Paris Club agreements amounts to $ 614 billion.

Low-income countries generally do not have access to these markets. The assistance from bilateral and multilateral donors remains vital for them. Non-Paris Club creditors are becoming an increasingly important source of financing for these countries. Yet despite the fact that Paris Club creditors now have to deal with far more complex and diverse debt situations than in 1956, their original principles still stand.

Members

Duty of Members

Permanent Members

The 22 Paris Club permanent members are countries with large exposure to other States woldwide and that agree on the main principles and rules of the Paris Club. The claims may be held directly by the government or through its appropriate institutions, especially Export credit agencies. These creditor countries have constantly applied the terms defined in the Paris Club Agreed Minutes to their bilateral claims and have settled any bilateral disputes or arrears with Paris Club countries, if any. The following countries are permanent Paris Club members:

AUSTRALIA

AUSTRIA

BELGIUM

BRAZIL

CANADA

DENMARK

FINLAND

FRANCE

GERMANY

IRELAND

ISRAEL

ITALY

JAPAN

KOREA

NETHERLANDS

NORWAY

RUSSIAN FEDERATION

SPAIN

SWEDEN

SWITZERLAND

UNITED KINGDOM

UNITED STATES OF AMERICA

Ad Hoc Members

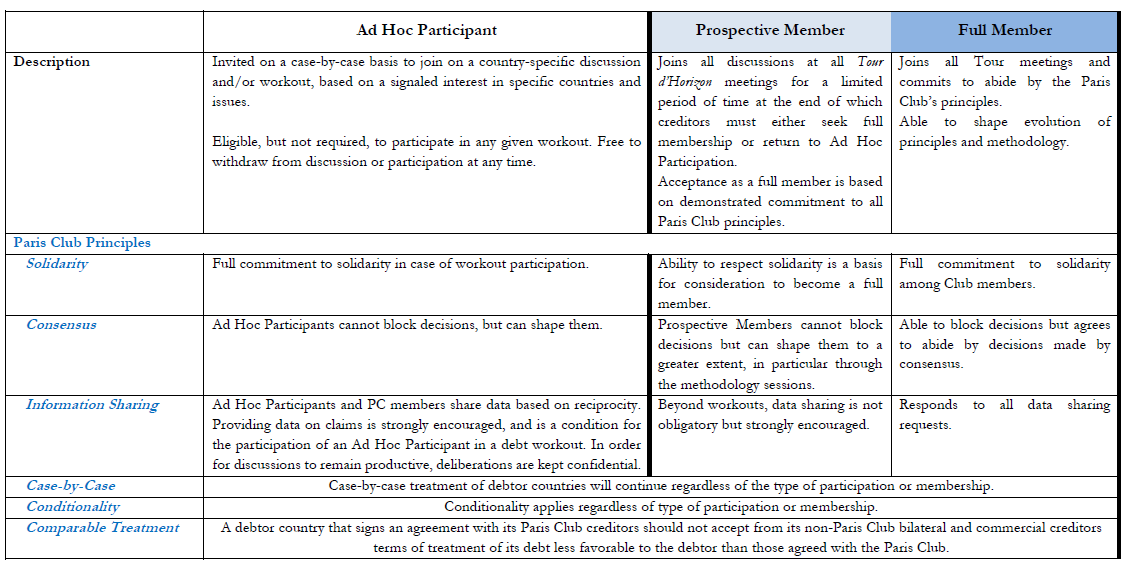

Other official creditors can also actively participate in negotiation sessions or in monthly “Tours d’Horizon” discussions, subject to the agreement of permanent members and of the debtor country. When participating in Paris Club discussions, invited creditors act in good faith and abide by the practices described in the table below. The following creditors have participated as creditors in some Paris Club agreements or Tours d’Horizon in an ad hoc manner:

Abu Dhabi

Argentina

China

Czech Republic

India

Kuwait

Mexico

Morocco

New Zealand

Portugal

Saudi Arabia

South Africa * prospective member on 8 July 2022

Trinidad and Tobago

Turkey

Development and History of Paris Club

Early Stage

In 1956, the world economy was emerging from the aftermath of the Second World War. The Bretton Woods institutions were in the early stages of their existence, international capital flows were scarce, and exchange rates were fixed. Few African countries were independent and the world was divided along Cold War lines. Yet there was a strong spirit of international cooperation in the Western world and, when Argentina voiced the need to meet its sovereign creditors to prevent a default, France offered to host an exceptional three-day meeting in Paris that took place from 14 to 16 May 1956.

Dealing with the Debt Crisis (1981-1996)

1981 marked a turning point in Paris Club activity. The number of agreements concluded per year rose to more than ten and even to 24 in 1989. This was the famous “debt crisis” of the 1980s, triggered by Mexico defaulting on its sovereign debt in 1982 and followed by a long period during which many countries negotiated multiple debt agreements with the Paris Club, mainly in sub-Saharan Africa and Latin America, but also in Asia (the Philippines), the Middle East (Egypt and Jordan) and Eastern Europe (Poland, Yugoslavia and Bulgaria). Following the collapse of the Soviet Union in 1992, Russia joined the list of countries that have concluded an agreement with the Paris Club. So by the 1990s, Paris Club activity had become truly international.

Debt Burden Enlarges for some Countries

In 1996, the international financial community realized that the external debt situation of a number of mostly African low-income countries had become extremely difficult. This was the starting point of the Heavily Indebted Poor Countries (HIPC) Initiative.

The HIPC Initiative demonstrated the need for creditors to take a more tailored approach when deciding on debt treatment for debtor countries. Hence in October 2003, Paris Club creditors adopted a new approach to non-HIPCs: the “Evian Approach”.

Evian Approach

General frame of the Evian approach

- Analysis the sustability

When a country approaches the Paris Club, the sustainability of its debt would be examined, before the financing assurances are requested, in coordination with the IMF according to its standard debt sustainability analysis to see whether there might be a sustainability concern in addition to financing needs. Specific attention would be paid to the evolution of debt ratios over time as well as to the debtor country’s economic potential; its efforts to adjust fiscal policy; the existence, durability and magnitude of an external shock; the assumptions and variables underlying the IMF baseline scenario; the debtor’s previous recourse to Paris Club and the likelihood of future recourse. If a sustainability issue is identified, Paris Club creditors will develop their own view on the debt sustainability analysis in close coordination with the IMF.

-

if face liquidity problem

For countries who face a liquidity problem but are considered to have sustainable debt going forward, the Paris Club would design debt treatments on the basis of the existing terms. However, Paris Club creditors agreed that the rationale for the eligibility to these terms would be carefully examined, and that all the range built-into the terms including through shorter grace period and maturities, would be used to adapt the debt treatment to the financial situation of the debtor country. Countries with the most serious debt problems will be dealt with more effectively under the new options for debt treatments. For other countries, the most generous implementation of existing terms would only be used when justified.

-

if not sustainable or need special treatment

For countries whose debt has been agreed by the IMF and the Paris Club creditor countries to be unsustainable, who are committed to policies that will secure an exit from the Paris Club in the framework of their IMF arrangements, and who will seek comparable treatment from their other external creditors, including the private sector, Paris Club creditors agreed that they would participate in a comprehensive debt treatment. However, according to usual Paris Club practices, eligibility to a comprehensive debt treatment is to be decided on a case-by-case basis.

In such cases, debt treatment would be delivered according to a specific process designed to maintain a strong link with economic performance and public debt management. The process could have three stages. In the first stage, the country would have a first IMF arrangement and the Paris Club would grant a flow treatment. This stage, whose length could range from one to three years according to the past performance of the debtor country, would enable the debtor country to establish a satisfactory track record in implementing an IMF program and in paying Paris Club creditors. In the second stage, the country would have a second arrangement with the IMF and could receive the first phase of an exit treatment granted by the Paris Club. In the third stage, the Paris Club could complete the exit treatment based on the full implementation of the successor IMF program and a satisfactory payment record with the Paris Club. The country would thus only fully benefit from the exit treatment if it maintains its track record over time.

Data

There data in the website yoy.

Insights

Refer to Horn et al., (2021) figure 9 in page 13, Paris Club seems played important role during 2010s.

tbc

Reference

https://clubdeparis.org/en