Factors affecting stocks valuation are liquidity of the market, Prosperity of the overall market, investors’ preference, etc.

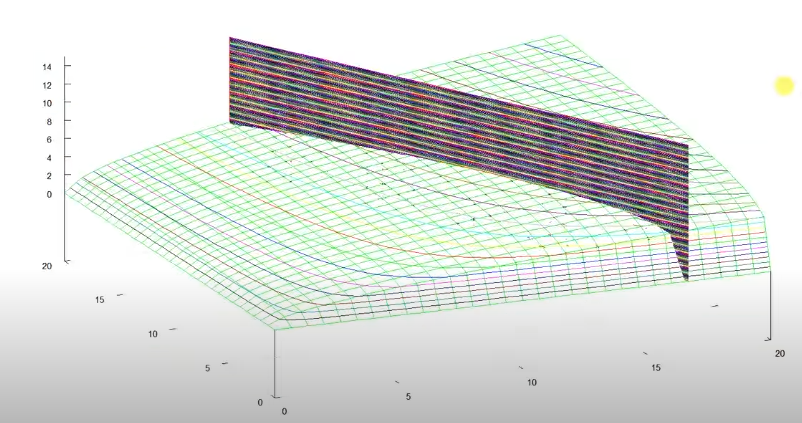

In simply the DCF model, the impacts of those factors would be reflected in the discounted rate. As we consider separating the interest rate into a risk-free rate and the premium for a certain firm, the premium is idiosyncratic. For example, with low liquidity of the capital market, investors would expect a liquidity premium; worse economic conditions and low investors’ preferences would increase the risk premium.

Therefore, we could predict that an increase in the federal fund rate, as what the Fed is doing to face the hyper-inflation, and quantitive tightening would have the following impacts. Firstly, the quantitive tightening (QT) or TAPER means the Fed would actively decrease its balance sheet by sell-out/stoping re-issuing those MBS or Government debts. This conduction would decrease the amount of money available in the market, and thus result in higher costs of borrowing money. The liquidity premium would increase. Secondly, if there is less supply of money, then the higher cost of using money, the interest rate, would increase. Both the increase in the interest rate and the premium would increase the discount rate for a certain company. Applying the higher discounted rate to the DCF model for that firm would end up with a lower valuation.

Conclusively, an increase in the Federal Fund Rate and QT/TAPER would generally result in a lower valuation of firms.