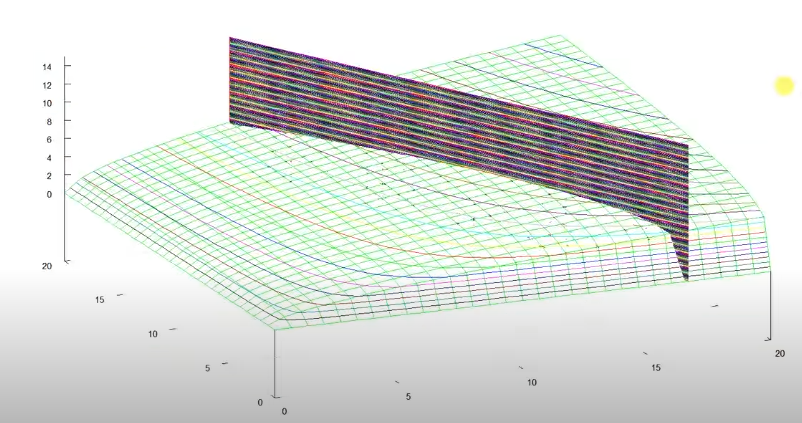

CES could be either production or utility function. It provides a clear picture of how producers or consumers choose between different choices (elasticity of substitution).

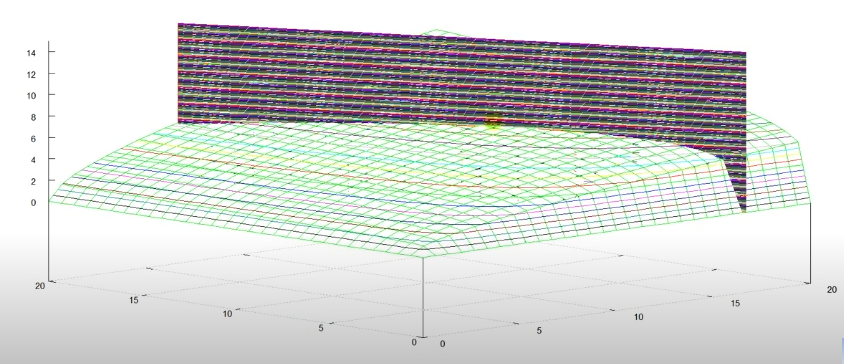

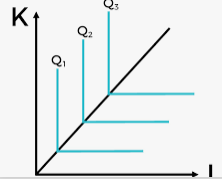

CES Production

The two factor (capital, labour) CES production function was introduced by Solow and later made popular by Arrow.

$$Q=A\cdot(\alpha K^{-\rho}+(1-\alpha)L^{-\rho})^{-\frac{1}{\rho}}$$

- \(\alpha\) measures the relative proportion spent across K and L.

- \(\rho=\frac{\sigma-1}{\sigma}\) is the substitution parameter.

- \(\sigma=\frac{1}{1-\rho}\) is the elasticity of substitution.

While identical producers maximise their profits and markets get competitive, Marginal Product of Labour and Marginal Product of Capital follow,

$$MP_L=\frac{\partial Q}{\partial L}=w$$

$$MP_K=\frac{\partial Q}{\partial K}=r$$

So we get,

$$ \frac{w}{r}=\frac{1-\alpha}{\alpha}(\frac{K}{L})^{\rho+1} $$

$$\frac{K}{L}=(\frac{\alpha}{1-\alpha}\frac{w}{r})^{\frac{1}{1+\rho}}$$

Here, we get the substitution of K and L is a function of the price, w & r. As we are studying the elasticity of substitution, in other words how W/L is affected by w/r, we take derivatives later. We denote \(V=K/L\), and \(Z=w/r\). Then,

$$V=(\frac{\alpha}{1-\alpha}Z)^{\frac{1}{1+\rho}}$$

The Elasticity of Substitution (the percentage change of K/L in terms of the percentage change of w/r) is,

$$ \sigma=\frac{dV/V}{dZ/Z}=\frac{dV}{dZ}\frac{Z}{V}=\frac{1}{1+\rho} $$

Therefore, we get the elasticity of substitution becomes constant, depending on \(\rho\). The interesting thing happens here.

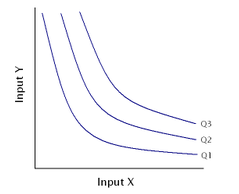

- If \(-1<\rho<0\), then \(\sigma>1\).

- If \(0<\rho<\infty\), then \(\sigma<1\).

- If \(\rho=0\), then, \(\sigma=1\).

Utility Function

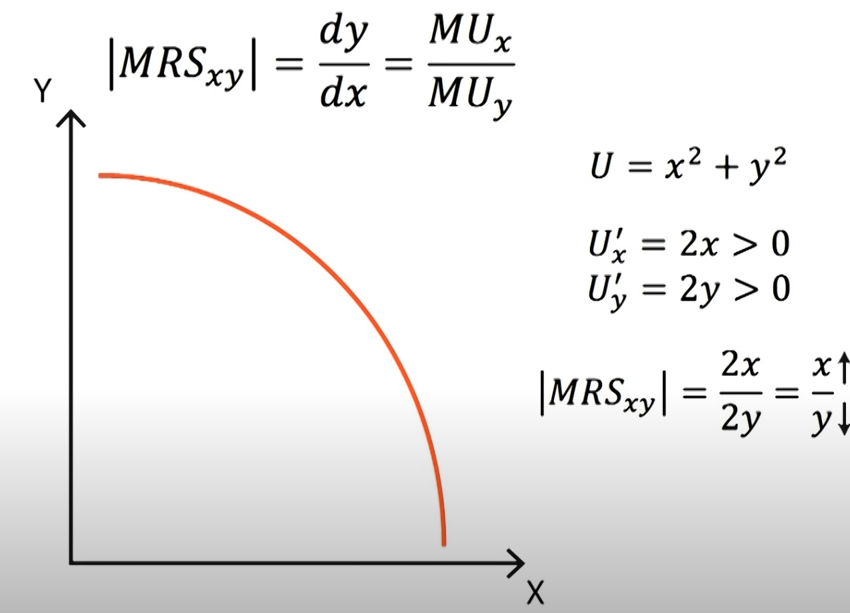

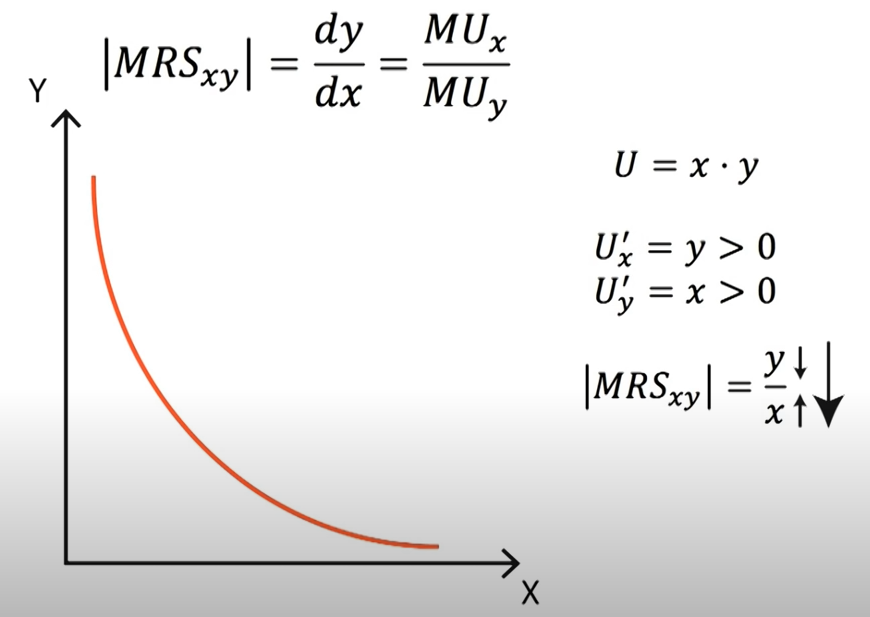

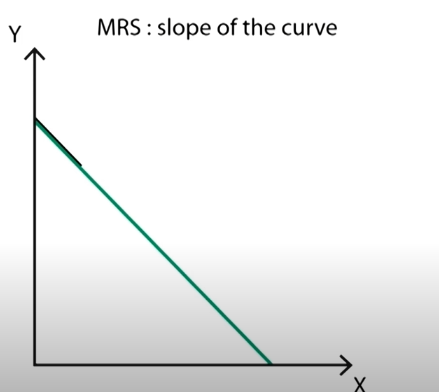

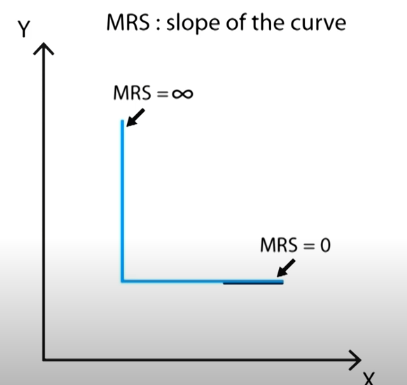

Marginal Rate of Substitution (MRS) measures the substitution rate between two goods while holding the utility constant. The elasticity between X and Y could be defined as the following,

$$ Elasticity=\frac{\%\Delta Y}{\% \Delta X}=\frac{\Delta Y/Y}{\Delta X/X}=\frac{X/Y}{\Delta X/\Delta Y} $$

The elasticity of substitution here is defined as how easy is to substitute between inputs, x or y. In another word, the change in the ratio of the use of two goods w.r.t. the ratio of their marginal price. In the utility function case, we can apply the formula,

$$\sigma=\frac{\Delta ln(X/Y)}{\Delta ln(MRS_{X,Y})}=\frac{\Delta ln(X/Y)}{\Delta ln(U_x/U_y)}= \frac{\Delta ln(X/Y)}{\Delta ln(U_x/U_y)} $$

$$\sigma=\frac{\frac{\Delta(X/Y)}{X/Y}}{\frac{\Delta (p_x/p_y)}{p_x/p_y}}$$

- \(U_x=\frac{\partial U}{\partial X}=p_x\)

- \(MRS_{X,Y}=\frac{dy}{dx}=\frac{U_x}{U_y}=p_x/p_y\) marginal price in equilibrium.

In the

$$ u(x,y)=(a x^{\rho}+b y^{\rho})^{1/\rho} $$

$$\sigma=\frac{1}{1-\rho}$$

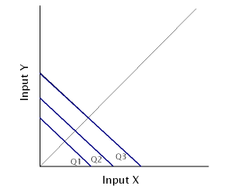

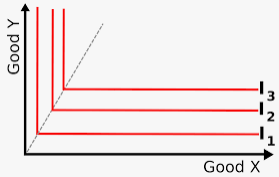

If \(\rho=1\), then \(\sigma\rightarrow \infty\).

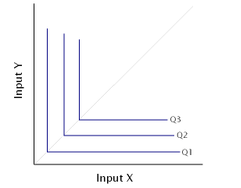

If \(\rho\rightarrow -\infty\), then \(\rho=0\).

Two common choices of CES production function are (1) Walras-Leontief-Harrod-Domar function; and (2) Cobb-Douglas function (P.S. but CES is not perfect, coz sigma always equal one).

As \(\rho=1\), the utility function would be a perfect substitute.

As \(\rho=-1\), the utility function would be pretty similar to the Cobb-Douglas form.

Later, the CES utility function could be applied to calculate the Marshallian demand function and Indirect utility function, and so on. Also, easy to show that the indirect utility function \(U(p_x,p_y,w)\) is homogenous degree of 0.

Reference

Arrow, K.J., Chenery, H.B., Minhas, B.S. and Solow, R.M., 1961. Capital-labor substitution and economic efficiency. The review of Economics and Statistics, 43(3), pp.225-250.