About Gold ?

There seems some “irrational” movements of gold price since the end of 2023.

How gold should be priced? What factors affect the pricing of gold. Here below are some of my reading and insights.

Typical Determinants

Typically, the gold price is considered to be correlated with a list of factors:

- Inflation

In counter with the inflation.

-

Long-term Real Interest Rate

TIPS, the Treasury Inflation-Protected Securities, is considered to be the real-interest rate, as the inflation rate is counter-deducted. The long-term rate, specifically 10-yr rate, is preferred as we generally assume holding the Gold in a long-term investment horizon. The long-term Real Interest Rate is considered as the opportunity of holding gold. Therefore, the higher rate, the greater the cost of holding golds, and less demand of gold. Price decrease thereafter.

-

US Dollar

The Brandon Wood System links the gold price with US Dollar, with 35USD = 1 ounce Gold. Since the collapse of Brandon Wood System, there is not a fixed exchange rate between USD and Gold anymore. However, USD is still the most important determinant of gold price in that the unit of Gold price is still USD/ounce. It is also like an exchange rate, the more per ounce value of gold is, the more USD/ounce should be. Or, contrastively, the weak USD is, the more USD/ounce shall be.

-

US Dollar Index

The US Dollar Index might be consider an proxy of the strength and weakness of US dollar. However, as US dollar is the weighted geometric mean of the exchange rates of six major currencies compared to the US dollar:

- Euro (EUR) – 57.6% weight

- Japanese yen (JPY) – 13.6% weight

- British pound (GBP) – 11.9% weight

- Canadian dollar (CAD) – 9.1% weight

- Swedish krona (SEK) – 4.2% weight

- Swiss franc (CHF) – 3.6% weight

The USD Index is actually a composite of weighted average of above listed currency. The increase of US dollar index means USD is appreciated w.r.t. above currencies. I.E. if USD appreciates w.r.t. EURO, then USDX is likely to increase.

Therefore, an increase in USDX means appreciation of USD, and then USD/ounce shall decrease, gold price decrease.

-

Risks / Uncertainty

-

Demand and Supply from Central Banks.

We ignore the impact of demand and supply from individuals and industries, but focus on the demand of Central Banks. Like what those CB did during February and March 2024 would increase the demand of gold price.

Empirical Research

Refer to the research report from CICC, a four-factor model is established. The authors specified the relationship between gold and those four factors, one by one.

- The dependent variable: Gold Price. (Also, attention that they focus on the gold price, not the return as machine learning usually do)

-

Explanatory Variables:

- US Real Interest rate

Capture the Opportunity Cost of holding gold. Similar as the explanation in the above section.

- US Dollar Index,

Similar as the explanation in the above section.

- Central Bank Net Gold Purchasing,

The supply side is limited, demand is mainly driven by the Central Banks of US, China, EU, JP, etc.

- US Gov Debt Level.

This factor represents the credibility of US dollar or US government. The greater US Debt level, the less credit-worthy the US gov is. Then, the more desire of holding gold as the counter party of US Dollar credibility.

The Statistic table is shown below.

The author argue that people do not need to consider the spurious regression though the R-squared is incredibly high. They state that the reason is that they are only considering the model like a co-integration model. They have tested the integration of the residual term, and find that the residual is stationary. High R-squared means there are less left in the residual.

Their explanation is like the Bull Shit. However, we just ignore the bull shit econometric modeling and statistic figure in the above table, as we are not doing academic. Let consider the predictable power and the implication of the model.

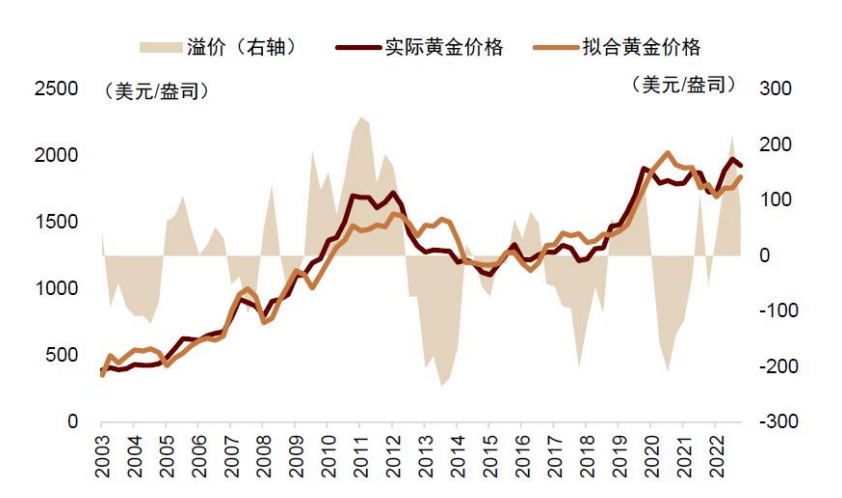

Here below is their simulated result and the real gold price movement. Let’s investigate is their model perform as good as stated in their report. Also, let’s see how ML way could perform.