Credibility Affects How the Market Reacts

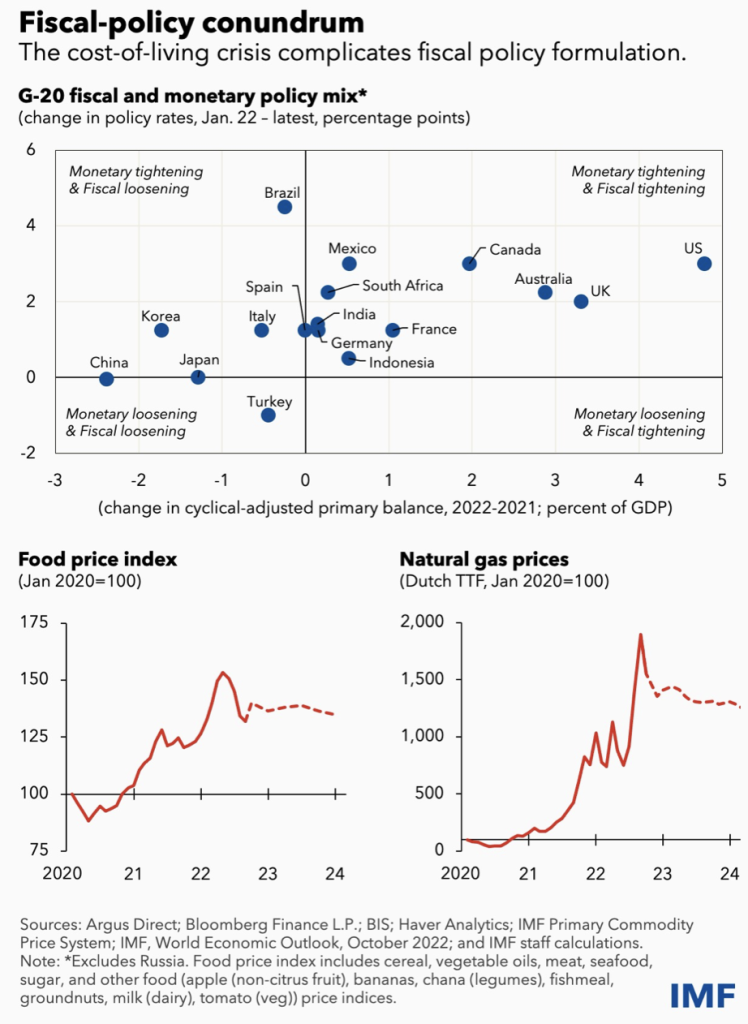

Preliminary: 货币政策 & 财政政策宽松,刺激经济短期,带来短期需求增加。M2 increases results in CPI increases. 但是:

- 1. 长期随着价格水平增加,output会回到 Y^*.

- 2. Inflation is nothing but a monetary phenomenon. Too much money chases too few goods and services, and then there would be inflation. 当货币超发,中期, Goods & Services的增加不足以匹配超发的货币时,通胀就产生了。

- P.S. 中期与否,取决于市场对资金的需求。Unrealistic Case 1:若为长期,人们仍然预期,未来的goods n services足以匹配过多的money,可能也不会带来Price Level的增加(“Technological Growth” Case)。Unrealistic Case 2:也可能短期,甚至超短期,Private Sectors 嫉妒悲观,不相信任何public sector’s credibility,不吸纳任何money,不用任何moeny去买goods & service,哪怕有helicopter drops。那么此时,print money means create inflation directly,印钱会在超短期就带来通胀!

Based on the previous assumption: One factor that affects how the market reacts to QE is the Credibility of the Public Section.

Where the Credibility comes from? It’s from the Stability of a State, People’s expectations about future development, Demographic Structure, Gov’s Leverage Rate and Implicit Leverage rate, and so on. Because the Public sector can do Ponzi, and renew their debts indefinitely.

After Inflation

We assume that the public sector is credible and would not default, and the stability and social structures are still healthy. Then, QE result in too much money chasing too few goods & services, and inflation emerges.

After the inflation, how do people react?

- 1. Pour money into the Heavy-capitalised assets, such as real estate and ‘equity’ shares. Then Asset Price increases to absorb extra money. The advantage is that goods and services (necessities) might not appreciate a lot. The disadvantage is that asset price increase is still not a healthy phenomenon, and systematic troubles accumulate because the bubble collapses one day. If the Bubble Collapses, the CB must reduce liquidity (money). Let’s move case 2 then.

- 2. QT. However, QT might be too dangerous, because high financial costs would increase financial burdens for highly leveraged households and firms. Defaults and Disposal Sales increase. Asset’s price slips. The current financial markets are highly securitised and synthetic. A decrease in core assets would result in a series of dangerous chain reactions. Potential Systematic Risks come true.

- 3. Technological Growth brings extra demands or something else, to absorb extra money.

- 3. However, Technological Growth might be ambiguous, and is highly unlikely to happen, at least in the current situation. It is only a potential solution and is less likely to happen.

- If case 3 not working, we have to move back to case 2.

- Withdraw Liquidity (money), and kill inflation. Asset Prices, such as housing prices and stock prices, evaporate. In this case, necessities’ prices are less likely to be affected because they are rigid. Housing Price is a large component of the CPI basket, reducing the price of assets might be a possibility to reduce inflation. However, the gov might choose to keep a relatively sustainable and stable recession by maintaining the housing price. House has a special function, living. So, killing the equity market, in which stock prices are not that directly linked with household living, might be the best choice for the gov.

The first case might be more effective because problems are left to future generations.

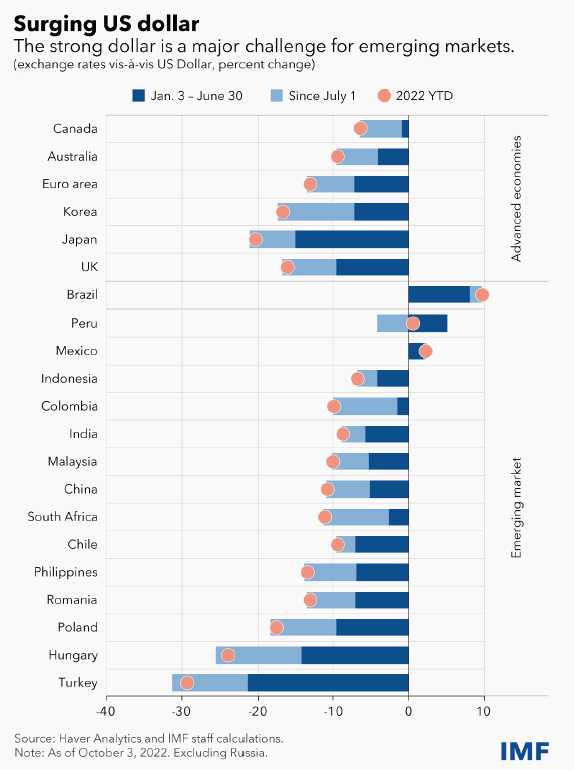

中国市场

Not in the same economic cycle as the U.S. market. There could be a reverse in the short term and even in the mid-term because the pandemic policies are forced to be stopped. However, I don’t have a positive expectation toward the market in the long run for mainly two reasons. 1. leverage increase in the local government. 2. credibility decreases. Those two reasons interact to make the problem even more severe.